1973 Gasoline Prices

The year 1973 marked a significant turning point in the global energy landscape, as the world witnessed the first of two major oil crises that would shape economic policies and energy strategies for decades to come. The 1973 oil crisis, also known as the 1973–74 oil embargo, was a pivotal event that highlighted the vulnerability of many nations' economies to fluctuations in the supply and price of petroleum. This period saw a rapid and unprecedented rise in gasoline prices, which had a profound impact on various industries, governments, and everyday consumers.

In this comprehensive article, we delve into the gasoline prices of 1973, exploring the historical context, the causes and consequences of the oil crisis, and the enduring lessons it offers for modern energy policies and our understanding of global energy markets. By examining this critical juncture in history, we gain valuable insights into the dynamics of energy supply, demand, and pricing, and the far-reaching implications they can have on the world stage.

The Oil Crisis: A Historical Context

To understand the gasoline prices of 1973, we must first explore the broader historical context of the 1973 oil crisis. This period was characterized by a complex interplay of geopolitical tensions, economic factors, and shifting global power dynamics.

The Rise of OPEC and the Oil Embargo

The Organization of the Petroleum Exporting Countries (OPEC) was founded in 1960 with the primary goal of uniting oil-producing nations to negotiate collectively and stabilize prices in the international oil market. By the early 1970s, OPEC's influence had grown significantly, and its members held a substantial portion of the world's oil reserves. In 1973, OPEC's power was put to the test when a combination of geopolitical events and strategic decisions led to an oil embargo against several Western nations, including the United States and its allies.

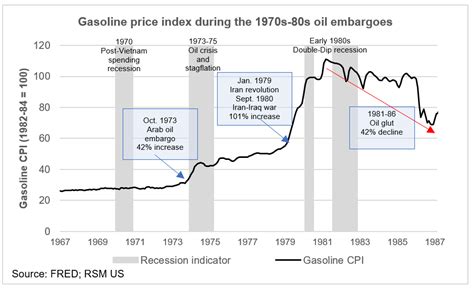

The embargo, which began in October 1973, was a response to Western support for Israel during the Yom Kippur War. OPEC members, led by Saudi Arabia, decided to reduce oil production and impose an embargo on countries perceived to be supportive of Israel. This action resulted in a rapid decrease in oil supply and a corresponding surge in prices. The embargo highlighted the strategic importance of oil as a political tool and demonstrated the power that oil-producing nations could wield over consumer countries.

The Impact on Global Energy Markets

The 1973 oil crisis had far-reaching consequences for global energy markets. The abrupt reduction in oil supply caused a sharp increase in oil prices, which, in turn, had a cascading effect on various sectors of the economy. The price of gasoline, a critical energy source for transportation, rose dramatically, leading to widespread economic and social disruptions.

The oil crisis of 1973 marked a shift in the global energy landscape, as it highlighted the vulnerability of economies heavily reliant on oil imports. The rapid increase in gasoline prices led to a recession in many countries, with businesses and consumers facing significant financial challenges. Industries such as transportation, manufacturing, and agriculture were particularly hard hit, as the high cost of fuel impacted their operations and profitability.

Gasoline Prices in 1973: A Historical Analysis

The gasoline prices of 1973 were a direct consequence of the oil crisis and the resulting disruption in the global energy supply chain. As OPEC reduced oil production and imposed an embargo, the demand for gasoline exceeded the available supply, leading to a significant price hike.

The Pre-Crisis Gasoline Market

Prior to the 1973 oil crisis, gasoline prices in the United States had been relatively stable. The average price of regular gasoline in the early 1970s was around $0.36 per gallon (adjusted for inflation, this equates to approximately $2.20 in 2023 dollars). This stability was largely due to the dominance of a few major oil companies, which controlled a significant portion of the market and set prices accordingly.

| Year | Average Gasoline Price ($/gallon) |

|---|---|

| 1970 | 0.35 |

| 1971 | 0.36 |

| 1972 | 0.36 |

However, this stability was about to be shattered by the events of 1973.

The Oil Crisis and Its Impact on Gasoline Prices

As the oil crisis unfolded, the effects on gasoline prices were immediate and dramatic. The OPEC embargo, coupled with the reduced oil supply, caused a rapid escalation in gasoline prices. By the end of 1973, the average price of gasoline had nearly doubled, reaching $0.62 per gallon (equivalent to approximately $3.80 in 2023 dollars). This price increase had a profound impact on consumers and businesses alike.

| Year | Average Gasoline Price ($/gallon) |

|---|---|

| 1973 | 0.62 |

The spike in gasoline prices led to widespread economic and social consequences. Consumers faced higher costs for transportation, which impacted their purchasing power and discretionary spending. Businesses, particularly those in the transportation and logistics sectors, saw their margins squeezed, leading to layoffs and reduced economic activity. The oil crisis also contributed to a period of high inflation, as the increased cost of energy rippled through the economy.

Regional Variations and Consumer Response

While the average gasoline price increased significantly during the oil crisis, it's important to note that there were regional variations in pricing. Factors such as local taxes, distribution costs, and the proximity to oil refineries influenced the price consumers paid at the pump. For instance, regions with a higher concentration of oil refineries, such as the Gulf Coast, often had lower gasoline prices compared to more remote areas.

Despite the price increase, consumers' response to the crisis varied. Some adapted by reducing their driving habits, carpooling, or investing in more fuel-efficient vehicles. Others turned to alternative transportation methods, such as public transit or bicycles, to mitigate the impact of high gasoline prices. However, for many, especially those in rural areas or dependent on personal vehicles for their livelihoods, the options were more limited, and the financial burden was significant.

💡 Expert Insight: The 1973 oil crisis and its impact on gasoline prices served as a stark reminder of the interconnectedness of global energy markets and the vulnerability of economies to sudden shifts in supply and demand. It highlighted the need for diversified energy portfolios, increased energy efficiency, and the exploration of alternative energy sources.

Lessons from the Past: Enduring Insights

The 1973 oil crisis and the corresponding gasoline price surge offer valuable lessons that continue to shape energy policies and strategies in the present day. Here are some key insights that have emerged from this historical event.

The Importance of Energy Security

One of the primary lessons from the 1973 oil crisis is the critical importance of energy security. The vulnerability of economies to disruptions in the global energy supply chain became painfully clear during this period. As a result, many nations have since prioritized the diversification of their energy sources and the development of domestic energy industries to reduce their dependence on foreign oil.

The Role of Renewable Energy

The oil crisis of 1973 also accelerated the exploration and development of renewable energy sources. The high cost of oil and gasoline during this period served as a catalyst for the growth of alternative energy industries, such as solar, wind, and hydroelectric power. Many countries began investing in renewable energy infrastructure and research, recognizing the potential for a more sustainable and secure energy future.

Energy Efficiency and Conservation

The impact of the oil crisis on gasoline prices led to a heightened awareness of energy efficiency and conservation. Governments and consumers alike began to prioritize energy-efficient technologies and practices. This shift encouraged the development of more fuel-efficient vehicles, improved building insulation, and the adoption of energy-saving habits, all of which contributed to a more sustainable approach to energy consumption.

The Complexity of Global Energy Markets

The 1973 oil crisis highlighted the intricate web of relationships and dependencies within the global energy market. It demonstrated that geopolitical tensions and strategic decisions in one region could have far-reaching consequences for energy prices and supply chains worldwide. This realization has led to a greater focus on international cooperation and the development of strategies to mitigate the impact of future energy disruptions.

Conclusion: A Legacy of Resilience and Innovation

The gasoline prices of 1973 were a consequence of a complex interplay of geopolitical events and economic factors. The oil crisis of that year served as a wake-up call, prompting nations and industries to reevaluate their energy strategies and priorities. The enduring legacy of this period is one of resilience and innovation, as it spurred the development of more sustainable and secure energy practices and technologies.

As we reflect on the gasoline prices of 1973 and the broader context of the oil crisis, we gain valuable insights into the dynamics of global energy markets and the importance of preparedness and diversification. While the world has made significant strides in energy efficiency and the adoption of renewable sources, the lessons from this historical event continue to guide our approach to energy policy and our understanding of the delicate balance between supply, demand, and pricing.

What caused the 1973 oil crisis and its impact on gasoline prices?

+The 1973 oil crisis was primarily caused by the OPEC oil embargo against several Western nations in response to their support for Israel during the Yom Kippur War. This embargo, coupled with reduced oil production, led to a significant decrease in oil supply and a corresponding surge in prices, including a near doubling of average gasoline prices.

How did the oil crisis of 1973 impact the global economy?

+The oil crisis of 1973 had a profound impact on the global economy, leading to a recession in many countries. Industries reliant on oil, such as transportation and manufacturing, faced significant financial challenges due to the increased cost of fuel. The crisis also contributed to a period of high inflation as the cost of energy rippled through the economy.

What were the long-term effects of the 1973 oil crisis on energy policies and strategies?

+The 1973 oil crisis led to a greater focus on energy security, the development of renewable energy sources, and energy efficiency. Nations prioritized the diversification of their energy portfolios and invested in domestic energy industries. It also highlighted the complexity of global energy markets and the need for international cooperation to mitigate future energy disruptions.