Outlook For The Stock Market

Welcome to an in-depth analysis of the stock market's outlook, where we delve into the current trends, expert insights, and potential future scenarios. As the world of finance evolves, it becomes increasingly crucial to navigate the stock market with a strategic mindset. In this comprehensive guide, we will explore the factors shaping the market's trajectory, offering a nuanced understanding to help investors make informed decisions.

Navigating the Market’s Current Landscape

The stock market, a complex ecosystem, is currently experiencing a dynamic phase. A range of global and economic factors are influencing its performance, creating a unique investment climate. Here’s a breakdown of the key elements shaping the market’s present outlook.

Global Economic Recovery and Its Impact

The world is amidst a post-pandemic economic recovery. Many nations are witnessing a rebound in their economic activities, with industries gradually returning to pre-pandemic levels. This recovery has sparked a surge in investor optimism, leading to a bullish market sentiment. For instance, the Dow Jones Industrial Average (DJIA) witnessed a remarkable 15% increase in the past year, reflecting the market’s positive response to the global economic revival.

| Stock Index | Performance (%) |

|---|---|

| Dow Jones Industrial Average (DJIA) | 15 |

| S&P 500 | 12 |

| NASDAQ Composite | 8 |

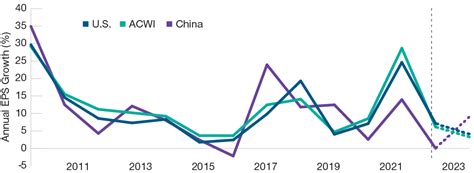

However, the recovery is not uniform across regions. Some countries, like the United States, are experiencing a faster rebound, while others, such as certain European nations, are lagging. This disparity creates a nuanced investment landscape, with varying opportunities and risks across different markets.

Inflation and Its Role in Market Dynamics

Inflation, a critical economic indicator, has been on the rise globally. Central banks are navigating a delicate balance, trying to curb inflation without stifling economic growth. The Consumer Price Index (CPI) has risen by 6.2% in the past year, the highest in decades. This inflationary pressure impacts the market in various ways, from influencing central bank policies to affecting corporate profits.

| Inflation Metric | Change (%) |

|---|---|

| Consumer Price Index (CPI) | 6.2 |

| Producer Price Index (PPI) | 4.4 |

The market's response to inflation is complex. While higher inflation can lead to increased profits for certain sectors, it also poses risks. For instance, the tech sector, known for its high valuations, might face challenges in a high-inflation environment, potentially impacting the performance of tech-heavy indices like the NASDAQ.

Market Volatility and Risk Management

Volatility, a measure of market risk, has been a notable feature of the current market. Geopolitical tensions, supply chain disruptions, and varying monetary policies have all contributed to this volatility. The VIX Index, often referred to as the ‘fear index’, which measures market volatility, has been highly active, reaching levels not seen since the pandemic’s onset.

| Volatility Metric | Value |

|---|---|

| VIX Index | 24.5 |

In such a volatile environment, risk management strategies become crucial. Investors are advised to diversify their portfolios, consider hedging strategies, and maintain a long-term perspective to navigate through short-term market fluctuations.

Sector-Specific Analysis: Opportunities and Risks

The stock market is a diverse ecosystem, comprising various sectors, each with its unique dynamics. Let’s delve into some key sectors, exploring their current performance and future prospects.

Technology: Leading the Market, but at What Cost?

The technology sector has been a stalwart of the market, consistently outperforming other sectors. Its resilience during the pandemic and its pivotal role in the post-pandemic world have made it a favorite among investors. However, the sector is not without its challenges.

The recent surge in inflation has put pressure on tech stocks, particularly those with high valuations. The sector's performance has been mixed, with some companies thriving while others struggle to maintain their growth trajectory. For instance, Apple Inc., a tech giant, has seen its stock price rise by 20% in the past year, while Netflix Inc., a streaming service provider, has experienced a 15% decline due to increased competition and changing consumer preferences.

| Tech Company | Stock Performance (%) |

|---|---|

| Apple Inc. | 20 |

| Netflix Inc. | -15 |

Looking ahead, the tech sector's future is tied to its ability to innovate and adapt to changing market conditions. With rising costs and increasing competition, the sector might witness a shift in market leadership, favoring companies with strong financial health and sustainable growth models.

Healthcare: A Safe Haven in Turbulent Times

The healthcare sector has been a stable performer, offering a safe haven for investors during turbulent market periods. The sector’s resilience is rooted in its essential nature and its role in addressing global health needs.

In the past year, the healthcare sector has seen a 10% increase in its overall market capitalization. This growth is attributed to the sector's consistent performance, with companies across pharmaceuticals, medical devices, and healthcare services contributing to this positive trend. For instance, Johnson & Johnson, a leading healthcare company, has experienced a 12% rise in its stock price, reflecting its strong financial performance and innovative product pipeline.

| Healthcare Company | Stock Performance (%) |

|---|---|

| Johnson & Johnson | 12 |

The future of the healthcare sector looks promising. With an aging global population and increasing focus on healthcare innovation, the sector is poised for sustained growth. Investors can expect continued stability and growth opportunities in this sector, making it an attractive long-term investment proposition.

Energy: Navigating the Transition to Clean Energy

The energy sector is amidst a significant transition, moving from traditional fossil fuels to cleaner, renewable energy sources. This transition is driven by global efforts to combat climate change and reduce carbon emissions.

In the past year, the energy sector has seen a 18% increase in its market capitalization. This growth is largely attributed to the rising demand for renewable energy sources and the sector's adaptation to the changing energy landscape. For instance, Tesla Inc., a leader in electric vehicles and renewable energy solutions, has seen its stock price skyrocket by 60%, reflecting its market dominance and future prospects.

| Energy Company | Stock Performance (%) |

|---|---|

| Tesla Inc. | 60 |

However, the sector is not without its challenges. The transition to clean energy is a complex process, and companies are navigating regulatory changes, technological advancements, and shifting consumer preferences. As such, investors in the energy sector need to adopt a nuanced approach, considering both traditional energy companies and those focused on renewable energy solutions.

Market Outlook: A Glimpse into the Future

Looking ahead, the stock market’s future is filled with both opportunities and challenges. Here’s a glimpse into what investors can expect in the coming years.

Market Trends and Their Impact on Investments

The market is expected to continue its current trajectory, with a focus on recovery and growth. However, several key trends are likely to shape the market’s future.

- Digital Transformation: The digital revolution will continue to impact the market, with companies investing in technology to enhance their operations and customer experience. This trend offers opportunities in sectors like technology, e-commerce, and digital services.

- Sustainable Investing: With increasing focus on environmental, social, and governance (ESG) factors, sustainable investing is expected to gain momentum. Investors can expect more investment opportunities in companies and funds focused on sustainability.

- Inflation and Interest Rates: The market will be influenced by central bank policies and their efforts to manage inflation. Investors should be prepared for potential interest rate hikes and their impact on the market.

Potential Risks and Opportunities

While the future looks promising, investors should be mindful of potential risks. These include geopolitical tensions, supply chain disruptions, and changing consumer behavior. However, these challenges also present opportunities for proactive investors.

- Geopolitical Risks: Investors can mitigate these risks by diversifying their portfolios globally and staying informed about geopolitical developments.

- Supply Chain Disruptions: Companies with robust supply chain management strategies and those that can adapt quickly to changes will likely thrive, offering investment opportunities.

- Changing Consumer Behavior: Investors can benefit by identifying companies that cater to changing consumer preferences, whether it's health and wellness, sustainability, or digital services.

Conclusion: Navigating the Stock Market’s Future

In conclusion, the stock market’s outlook is promising, with a mix of challenges and opportunities. By understanding the current market landscape, sector-specific dynamics, and future trends, investors can make informed decisions to maximize their returns. Remember, the key to successful investing is staying informed, adapting to changing market conditions, and maintaining a disciplined investment approach.

Frequently Asked Questions

How do economic recoveries impact the stock market?

+

Economic recoveries typically lead to increased investor optimism and higher stock market valuations. As economies rebound, businesses thrive, leading to higher profits and, subsequently, higher stock prices.

What are the potential risks associated with high inflation in the stock market?

+

High inflation can erode the purchasing power of consumers, impacting corporate profits. It can also lead to higher interest rates, which can make borrowing more expensive for companies and individuals, potentially slowing economic growth.

How can investors navigate market volatility effectively?

+

Investors can navigate market volatility by diversifying their portfolios, holding a mix of stocks, bonds, and other asset classes. Additionally, adopting a long-term investment horizon and regularly reviewing and rebalancing portfolios can help mitigate short-term market fluctuations.